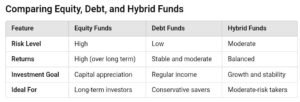

Mutual funds have become one of the most popular investment options for individuals seeking to grow their wealth while managing risk. However, with so many types of mutual funds available, it can be overwhelming to choose the right one. Understanding the main categories—equity funds, debt funds, and hybrid funds—is essential to make informed decisions based on your financial goals and risk tolerance.

In this article, we’ll break down these three types of mutual funds, their features, benefits, and who they’re best suited for.

1. Types of Mutual Funds: Equity Mutual Funds

What Are Equity Types of Mutual Funds?

Equity mutual funds primarily invest in stocks of companies. The goal is to achieve capital appreciation over the long term by taking advantage of the growth in stock markets. These funds are suitable for investors willing to take higher risks for potentially higher returns.

Types of Equity Funds

Equity funds are further categorized based on the type of companies or sectors they invest in:

- Large-Cap Funds: Invest in established companies with a large market capitalization. These funds are relatively stable and less volatile.

- Mid-Cap Funds: Target medium-sized companies with high growth potential but come with higher risks.

- Small-Cap Funds: Focus on small companies with high-risk, high-reward potential.

- Sectoral/Thematic Funds: Invest in specific sectors like IT, healthcare, or banking, making them highly volatile but rewarding if the sector performs well.

- ELSS (Equity-Linked Savings Scheme): Offer tax benefits under Section 80C of the Income Tax Act with a mandatory three-year lock-in period.

Advantages of Equity Types of Mutual Funds

- Potential for higher returns over the long term.

- Ideal for wealth creation and beating inflation.

- Managed by professional fund managers who pick stocks based on research.

Who Should Invest in Equity Funds?

Equity funds are suitable for:

- Investors with a high-risk tolerance.

- Those with long-term financial goals like retirement or children’s education.

- Individuals looking to beat inflation and grow wealth significantly.

2. Types of Mutual Funds: Debt Mutual Funds

What Are Debt Types of Mutual Funds?

Debt mutual funds invest in fixed-income securities such as government bonds, corporate bonds, treasury bills, and other money market instruments. The focus is on providing stable returns with lower risk compared to equity funds.

Types of Debt Types of Mutual Funds

Debt funds are categorized based on the maturity period of the securities they invest in:

- Liquid Funds: Invest in securities with a maturity of up to 91 days, making them highly liquid and suitable for parking short-term surplus cash.

- Short-Term and Ultra Short-Term Funds: Invest in instruments with a shorter maturity period, offering better returns than savings accounts.

- Income Funds: Focus on generating regular income by investing in bonds with varying maturities.

- Gilt Funds: Invest exclusively in government securities, ensuring high safety but moderate returns.

- Credit Risk Funds: Invest in lower-rated bonds with higher yields but carry increased risk.

Advantages of Debt Funds

- Lower risk compared to equity funds.

- Provide steady and predictable returns.

- High liquidity, especially in liquid and ultra-short-term funds.

- Ideal for investors seeking income rather than capital growth.

Who Should Invest in Debt Funds?

Debt funds are suitable for:

- Conservative investors seeking stability and safety.

- Those with short to medium-term financial goals.

- Investors looking for alternatives to fixed deposits.

3. Types of Mutual Funds: Hybrid Mutual Funds

What Are Hybrid Types of Mutual Funds?

Hybrid mutual funds combine investments in equity and debt instruments to balance risk and reward. They aim to provide capital appreciation and income generation simultaneously, making them a versatile option.

Types of Hybrid Funds

Hybrid funds vary based on the proportion of equity and debt in their portfolio:

- Aggressive Hybrid Funds: Invest predominantly in equities (65%-80%) with the remainder in debt instruments.

- Conservative Hybrid Funds: Allocate a higher percentage to debt (70%-90%) and the rest to equities, focusing on stability.

- Balanced Advantage Funds: Dynamically adjust the allocation between equity and debt based on market conditions.

- Arbitrage Funds: Exploit price differences between equity and derivative markets to generate low-risk returns.

Advantages of Hybrid Funds

- Balanced risk-reward profile.

- Diversification across asset classes.

- Flexibility to cater to different risk appetites and goals.

Who Should Invest in Hybrid Types of Mutual Funds?

Hybrid funds are suitable for:

- Moderate-risk investors seeking a mix of growth and stability.

- First-time investors who want exposure to both equity and debt.

- Individuals with medium-term goals like buying a house or funding a wedding.

Factors to Consider When Choosing a Mutual Fund

- Investment Objective

Clearly define your financial goals before choosing a fund. For instance, if you’re saving for retirement, equity or hybrid funds might be suitable, whereas debt funds are better for short-term goals. - Risk Appetite

Assess how much risk you’re comfortable taking. Equity funds carry higher risks but offer potentially higher returns, while debt funds are safer but have limited growth potential. - Time Horizon

- Short-Term Goals: Debt funds or liquid funds.

- Medium-Term Goals: Conservative hybrid funds.

- Long-Term Goals: Equity or aggressive hybrid funds.

- Expense Ratio

Check the fund’s expense ratio, which indicates the cost of managing the fund. Lower expense ratios translate to higher net returns for investors. - Fund Performance

Analyze the historical performance of the fund, though past performance doesn’t guarantee future returns. Look for consistency over multiple years.

Conclusion

Understanding the differences between equity, debt, and hybrid funds is crucial for selecting the right mutual fund for your needs. Each type of fund serves a unique purpose and caters to different investor profiles.

- Choose equity funds if you’re looking for high growth and are comfortable with market volatility.

- Opt for debt funds if stability and regular income are your priorities.

- Go with hybrid funds if you want a balanced approach with moderate risk and returns.

By aligning your investments with your goals, risk tolerance, and time horizon, you can maximize the benefits of mutual funds and build a robust financial future.

For more insights into mutual fund investment strategies, visit Rich Path. If you found this article helpful, share it with your friends and family. Have any questions or topics you’d like us to cover? Leave a comment below—we’d love to hear from you!

Read More-

Best Mutual Funds for Beginners in India: A Comprehensive Guide